By: Junjee Ramillete

A National budget is a document plan of public revenue and expenditure that is often passed by the legislature, approved by the chief executive-or president and presented by the Finance Minister to the nation. The budget is also known as the Annual Financial Statement of the country. This document estimates the anticipated government revenues and government expenditures for the ensuing (current) financial year. For example, only certain types of revenue may be imposed and collected. Property tax is frequently the basis for municipal and county revenues, while sales tax and/or income tax are the basis for state revenues, and income tax and corporate tax are the basis for national revenues.

Budget by Sector

The bulk of the budget will once again be devoted to Social Services—which will receive 34.8 percent of the National Budget—to continue the Administration’s focused campaign on poverty alleviation. Economic Services will claim the second highest sectoral allocation, with 25.5 percent devoted to it for 2013.

Budget by Expense Class

Under the 2013 National Budget, Capital Outlays (CO) will increase by 15.7 percent to P380 billion from this year’s level of P328.3 billion. Of this amount, Infrastructure and Other Capital Outlays will increase by 17.5 percent to P296.7 billion from P252.4 billion in 2012. The increases will help boost the momentum currently driving the transport, tourism and agriculture industries.

Meanwhile, Current Operating Expenditures (COE) account for P1.6 trillion of this Budget: an increase of 9.2 percent from the current year’s P1.465 trillion, which accounts for the jump in Personal Services (by 8.0 percent to P641.3 billion) to support the full implementation of the Salary Standardization Law III , among others. Meanwhile, Maintenance and Other Operating Expenditures (MOOE) are up by 17.5 percent to P313.3 billion due to the expansion of social and economic programs. Interest Payments are also up by 0.2 percent to P333.9 billion this year.

The budget for GOCCs posted a significant increase of 103.1 percent, bringing the total budget to P44.3 billion. Of this, subsidies increased by more than 114.3 percent to P42.3 billion.

The LGU shares in the National Budget also rose by 9.7 percent to P318.1 billion due to improved revenue collections in 2010, the base year for computing the Internal Revenue Allotment (IRA) of LGUs for 2013.

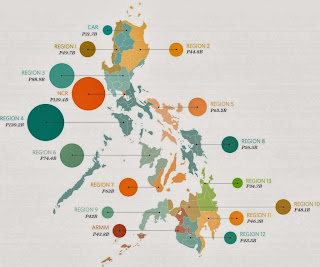

Budget by Region

The regional budgetary allocations increased by 28.5 percent to P990.4 billion, or 49.4 percent of the total proposed Budget for 2013. In comparison, the P770.5 billion allocation for the regions in 2011 was only 42.4 percent of the budget. In particular, budgetary allocations for Visayas and Mindanao grew by 21.8 percent and 22.1 percent year-on-year, respectively.

TOP 10 DEPARTMENTS

Walang komento:

Mag-post ng isang Komento